Will US anti-dumping duties change the pattern of shrimp imports?

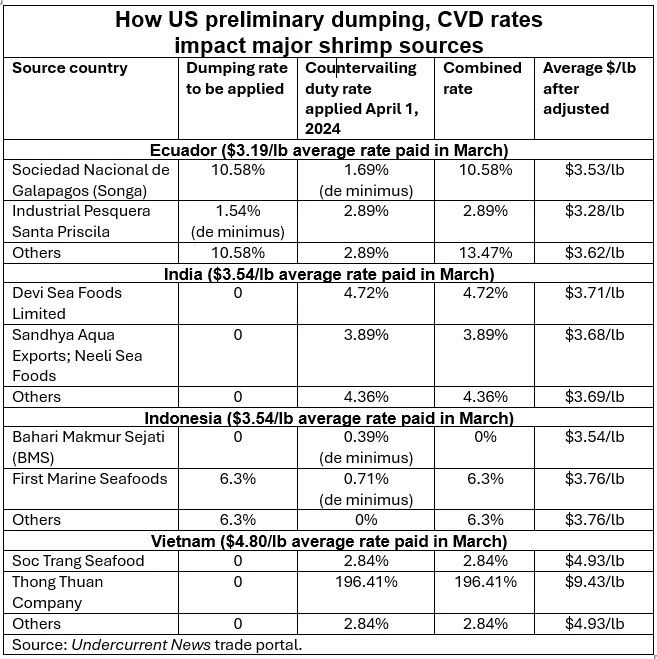

Last week, the U.S. Department of Commerce announced anti-dumping duties on shrimp imports from Ecuador and Indonesia, including 1.54% for Industrial Pesquera Santa Priscila and 10.58 % for Songa and other Ecuadorian producers. Bahari Makmur Sejati (BMS) will not be subject to anti-dumping duties, and First Marine Seafoods/Khom Foods and other Indonesian exporters will be subject to a preliminary tax rate of 6.3%.

So far, the Ecuadorian aquaculture association has yet to respond, but some exporters say that if santas still have a low price strategy, it will be a hit for other manufacturers.

In March, the average price of Ecuadorian shrimp exports to the United States was $3.19/lb, including anti-dumping duties and countervailing duties (2.89%), the cost of Santa vannamei shrimp will be $3.28/lb, $0.25/lb cheaper than shrimp Emperor and $0.34/lb cheaper than other Ecuadorian producers.

If anti-dumping duties are added, the gap between Ecuador's shrimp cost prices and those of India, Indonesia and Vietnam reduces significantly. From the feedback of US importers, this anti-dumping duty is not enough to change the existing import pattern. In the last three years, the number of shrimp imports to the United States has declined year by year, with imports falling to 897,000 tons in 2021, 841,000 tons in 2022, and 788,000 tons in 2023. In 2023, Indian shrimp accounted for 38% of the market share in the United States, 26% in Ecuador, 19% in Indonesia, and 8% in Vietnam.

Jeff Stern, president of Illinois-based importer Central Seaway Company (CenSea), told UCN: "I don't think there will be a major change in the supply of shrimp. India wanted Ecuador and Indonesia to be hit with a very high anti-dumping rate, but that didn't happen."

Donelson Berger, category manager at Stavis Seafoods in Boston, said the current supply of shrimp in the United States is greater than demand, because imports increased in February and March compared with the same period last year, which is thought to be a hoarding behavior by importers before the tax takes effect. "We all bought extra products to hedge, which now looks like a very smart decision."

"Now that the tax has been announced and the U.S. merchants have a lot of inventory, I expect the import figures to level off in the future. The cost of cold storage is as high as $0.06/lb. Even if the price of shrimp rises in a few months, you have to make up the difference to the cold storage." "Overall, inventories are high right now, and supply is much greater than demand," Berger said. For example, the market demand is only 80 pounds, and we've been trying to sell 100 pounds of shrimp in. Normally, there are more imports in the second half of the year, accounting for 60% of the year, so imports in the second half of the year may not fall. "But there is no reason to expect a significant increase in import , exporters have been shipping globally, importers are buying as needed and we are looking at a long-term oversupplied market."

References

Undercurrentnews