Fewer orders, lower prices... Aquatic product exports are facing difficulties

The export market is sluggish! In May, China total export of aquatic products decreased by 10.4%, and the export price of tilapia dropped by as much as US$0.6/lb!

"Since the second half of last year, the export market of aquatic products has continued to decline. Especially after the Spring Festival, the downward trend of most exported aquatic products has become more obvious." Recently, said by an aquatic product company with export business.

"On the one hand, the export orders of aquatic products have decreased; on the other hand, in the overall economic downturn in the world, the exports of high-end aquatic products is worse than that of relatively cheap aquatic products." According to a tilapia export company. In the first half of 2023, this company’s tilapia export orders fell by more than 30% year-on-year.

Relevant survey data show that in the first quarter of this year, 55% of export companies reported a decline in export orders, of which 13% of foreign trade orders fell by 80% year-on-year and 25% of companies fell by 30%-50%.

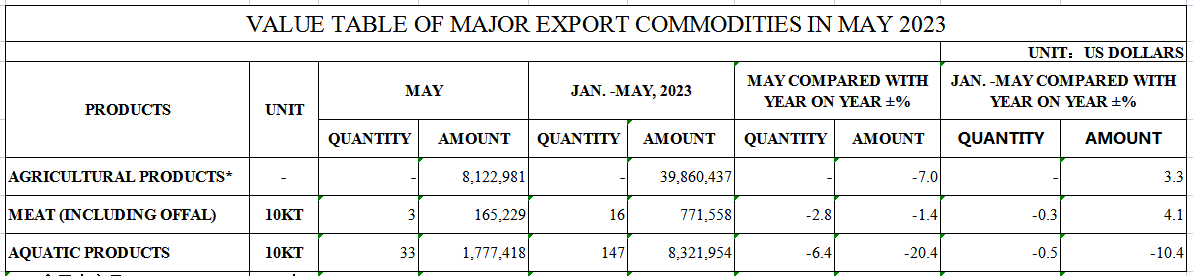

According to China Customs Data, from January to May, the total export volume of China aquatic products was about 1.47 million tons, a year-on-year decrease of 0.5%, of which the total export volume in May decreased by 6.4% compared with the same period last year. The total amount was about 8.322 billion US dollars, a year-on-year decrease of about 10.4%, of which the total export value in May fell by about 20.4%. From this point of view, the downward trend of the price of China export aquatic products is particularly obvious.

In addition, regarding tilapia, one of China most representative export aquatic products, Xie Hai, director of Zhaoqing Zhongye Aquatic Products Co., Ltd., said that tilapia exported to the United States is subject to a 25% tariff. According to the data of the past ten years, the price and volume of tilapia exported to the US market will be higher than that of Vietnamese pangasius. However, in the past two years, the consumption and price of pangasius in the U.S. market have been increasing, while that of tilapia is on the decline, which reflects the overall decline in consumption of tilapia in the U.S. market.

"In 2022, the lowest price of tilapia exported to the United States was around US$1.9/lb and the current price has dropped to US$1.3-1.6/lb. In addition, the United States can import tilapia from Brazil, Honduras and other American countries. There is no tariff basically that imported from such countries, which adds to the pressure on China tilapia exports.”

The reason for the export dilemma: the slow digestion of inventory in foreign markets, the transfer of imported material processing to Southeast Asian countries, and the exports may pick up in September.

Since the beginning of 2023, what is the reason for the continuous downturn in the export market of aquatic products?

Liu Zidan, deputy general manager of Hainan XF Co., Ltd., believes that there are two main reasons for the sluggish export market of aquatic products: "First, many companies in overseas have stockpiled a large amount of inventory from the end of 2021 to the beginning of 2022. In the first half of 2022, the overall import volume of aquatic products is relatively large in US, therefore the market inventory is relatively sufficient.

On the other hand, due to the impact of foreign inflation and US dollar interest rate hikes, the import price was relatively high in early 2022 compared with the current price. If foreign importers do not choose to reduce prices significantly to sell, the inventory digestion will slow down. Based on these two points, the inventory of aquatic products in foreign markets is relatively sufficient, and the demand for imports has declined. Therefore, domestic export aquatic products will face the dilemma of less order. "

In addition, according to industry analysts, from a macro point of view, due to the relatively high costs of domestic water, electricity and labor, more and more orders for processing with imported materials are transferred to Southeast Asian countries such as Vietnam, which also makes the export volume of aquatic products processed with imported materials in China decreased.

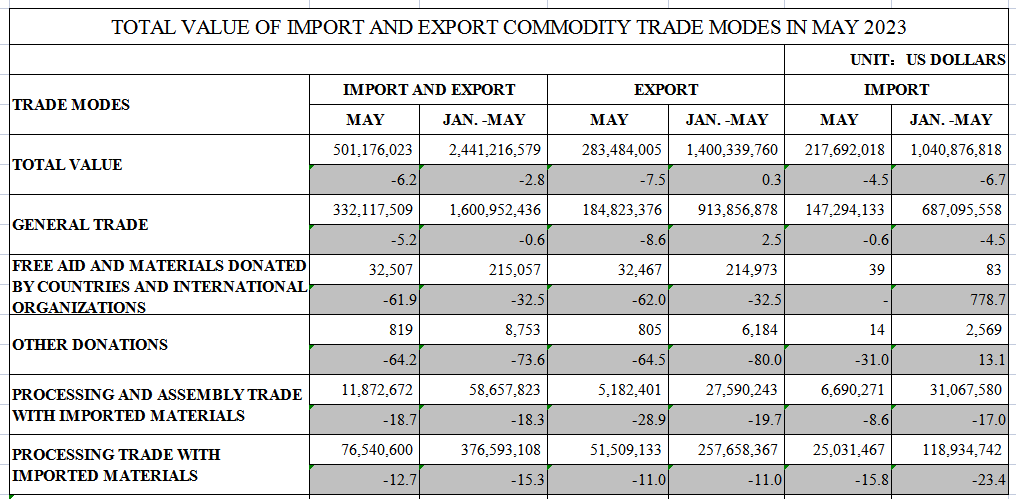

The data also seems to confirm this trend: From January to May 2023, China total exports of imported materials processing trade (including aquatic products) fell by 11% year-on-year.

However, it is understood that foreign markets start to stock up for Christmas and New Year’s Day from August to September each year. In general, the purchasing volume will be prepared until April of the following year. Therefore, the peak season of aquatic products foreign trade in the second half of 2023 may boost the current sluggish export market to a certain extent.

Export companies are turning more to the domestic market: intensifying the involution of the domestic market, and creating differentiated products in subdivided markets to avoid homogeneous competition.

In the case of blocked exports, many export companies have also begun to deploy more in the domestic market.

On June 28, Guolian Aquatic Products stated at the 2022 annual performance briefing that in response to Sino-US trade frictions, they have adjusted and completed business layout, focus on expanding the domestic market while expand non-US markets; consolidate the US market and develop non-US markets simultaneously. They also stabilize existing business in the US and expand incremental business. In response to the loss of SSC in the United States in 2022 under high inflation, they adjusted the procurement strategy of SSC, and shortened the procurement cycle to control the risk of price fluctuations effectively.

At the same time, as one of the largest aquatic product export companies in China, Shandong Meijia Group Co., Ltd. starts to fully deploy the domestic market from October 2021. In 2022, the total import and export volume exceeded 100,000 tons, of which the import volume was about 60,000 tons. In 2022, the sales revenue in the domestic market exceeded 1 billion yuan, increased by more than 40% in the first quarter of 2023.

According to Ma Dejun, general manager of the Marketing Center Management Department of Shandong Meijia Group Co., Ltd., leading export companies including Meijia are currently transforming into two aspects: one is to make full use of domestic and foreign market, accelerating two market layouts of China and overseas. The second is to get out of the market of homogeneous competition, select the right market and positioning, and gradually transform and upgrade to composite products.

However, for many enterprises, the transition from export to domestic market is not easy.

On the one hand, the exported seafood products are mainly raw materials and rough processed products, while the domestic market consumes more deep-processed aquatic products. Many enterprises require the rearrangement of production lines, which will face the investment and transition of production, technology and equipment. According to industry estimates, this process will take about one year.

On the other hand, there is a big difference between export and domestic sales in terms of consumption preference and product demand. During the transformation, market thinking needs to be changed. It is also a challenge for many small and medium-sized enterprises whether they can successfully operate both foreign and domestic sales markets.

Ma Dejun said that export companies are transitioning to the domestic market and a large number of products of export companies enter the domestic market. Homogenized products will intensify the involution in the domestic market to a certain extent; in addition, for small and medium-sized enterprises, foreign and domestic trade is two completely different strategies, coupled with the imperfect rules of the domestic market and the lack of equal competition are constrained by factors such as the fact that large initial investment may not necessarily achieve ideal results.

"Therefore, when companies switch to domestic sales, they should position themselves well and even choose a more subdivided market. In one market, they should focus on the quality of their products, refine them, make new product, develop their own characteristics and brands, and avoid compete and involute on homogenization product. On the other hand, small and medium-sized enterprises can focus on the advantages of a certain link of the industrial chain on the basis of the existing industry, jointly build a complete industrial chain with large enterprises to achieve a win-win situation.”