Will shipping cost decrease in the second half of 2024?

The rising cost of shipping this year has become one of the most serious challenges facing the global whitefish industry. According to a senior executive at Danish shipping company AP Moller-Maersk, the market does not seem to see a cooling trend in freight rates before the end of the year.

The cost of shipping a standard container from China to Europe has more than tripled in the past few months to around $9,000, and the European pollock processing industry has been hardest hit because there are currently no alternatives, Thue Barford, Maersk's global seafood director, told UCN.

"European processing plants are very dependent on Chinese imports of pollock, and the US ban (banning the import of Russian raw materials from third-party countries) means that more US pollock to stay in the North American market, European processing plants can only purchase secondary frozen fish fillets from China, using raw materials from Russia." From a supplier’s point of view, the European market has no choice but to replace pollock with expensive cod, and there are not enough of them. How do we get out of this mess? I don't see any way out yet."

“For some other varieties, such as shrimp, we will see changes in the purchasing area. Europe imports a lot of shrimp from India and other Asian countries, but now it can be imported from Ecuador, and South American freight is not as big as Asia's. "

Speaking about future freight rises and falls, Barford said: "There may be a little bit of upside in the Christmas peak, but I think we are close to the peak now. First, the capacity will increase, the fleet size is expanding, a number of new vessels will be commissioned this year, next year will also be; Second, the detour to South Africa from the Suez Canal has lengthened transit times, and unless something unpredictable happens again, costs will not rise further."

"After the Christmas rush is over and new vessels are opened, prices will adjust downward. I don't expect that to happen until next year, when global trade has to find a new equilibrium, and once the Red Sea situation returns to normal, more ships will start going through the Suez Canal, but there will still be some ships going around Africa."

Some time ago, seafood companies accused shipping companies of profiteering, Barford explained: "To some extent, our price increases may seem excessive, but the problem is that we also bear more costs because we have to charter more vessels in advance because many ships cannot pass through the Red Sea at the moment." Shipowners, knowing the demand from shipping companies, will raise charter rates, which are still high and may last a year or two. "Once the overall fees come down, a lot of customers will want to renew the contract or even break it, so we have to recoup the costs in advance now. Negotiations are tough and if we all meet the customer's demands, we will lose money."

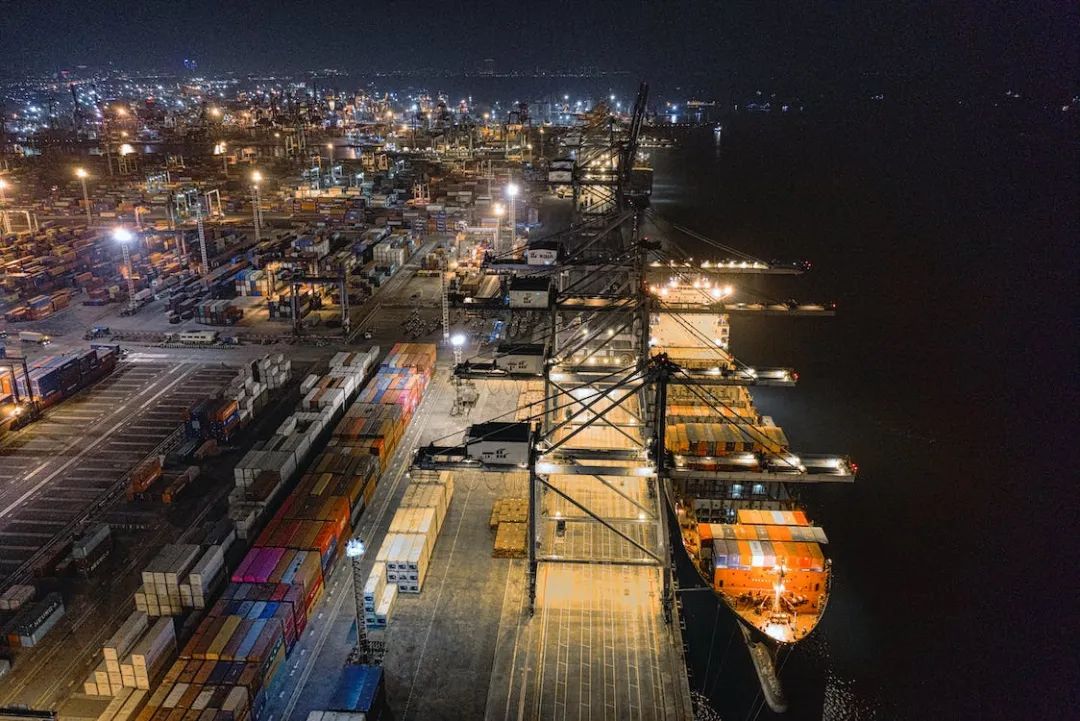

The crisis in the Red Sea began in December last year when Houthi militants in Yemen began attacking ships in the Red Sea. Barford noted that the cost of drones used by the Houthis to attack ships is low, while the cost of shooting them down is high. "You can buy a fleet of drones for $5,000- $10,000, and it costs hundreds of thousands of dollars to shoot them down, which by its nature is not sustainable." After a month and a half of turmoil, most shipping companies chose to give up and rerouted to South Africa, where they charged an extra $1,000- $2,000 surcharge, and by the end of the first quarter, South Africa was the new normal shipping line, with more regularity. First of all, the number of ships should be increased to maintain transport between Asia and Europe. Second, the transportation cycle has increased, and the cost of trade finance has risen under high interest rates. The third is to use more fuel, when the cargo ship to accelerate forward, the same range will use more fuel, for example, to increase the speed of 25%, you need to use 25% more fuel; Finally, the change of route caused some port congestion and ships had to circle around to find a place to dock."

Barford said the peak season in Europe usually began in July, and in August, if it went around South Africa, it meant two to three months early in the Christmas rush, and for shipping companies, to remove some of the operational forces from those that were not strategically important to protect the main routes of Asia and Europe. This, in turn, means that Africa and Latin America are going down, leading to rising costs for routes in these areas.

Reference : UCN