U.S. tilapia and basa prices continue to firm, inventories are low, and demand is stable and strong

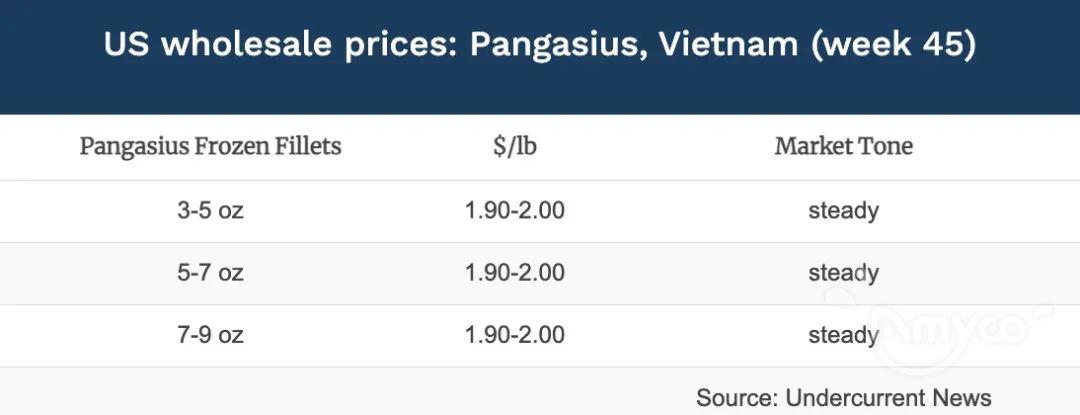

In the United States imported farmed white fish (mainly tilapia and basa fish) market, affected by the tight supply chain, the overall wholesale price is still at a high level, and the upward pressure on prices continues, especially for large-size fish fillets.

As of Week 45, U.S. frozen tilapia prices are as follows:

In recent weeks, the price of tilapia raw materials in Guangdong and Hainan has fallen, with the price of 500-800g in Guangdong falling to CNY 9.60/kg and that in Hainan falling to CNY 10.00/kg, and the processing plant has basically maintained full capacity. Reflected in the US market, the price trend of frozen fish fillets has a consistent correlation with the cost of raw materials in China, and the market has a certain elasticity.

If we take into account the exchange rate fluctuations, especially the central exchange rate of RMB against the US dollar before and after the US election, the US market price has also risen slightly, from the feedback of wholesalers, the current inventory is tight, and the US demand is stable and strong, we do not rule out the possibility of further price rises in the future.

As regard to Basa fish , the supply of the US market is also becoming tight, and bad weather in Vietnam caused massive fish losses, limiting the supply of fish, resulting in a decline in large-size fillet production capacity.

In addition, the upward pressure on freight costs will continue at the end of the year, and the cost of feed, energy and other agricultural inputs in Vietnam is also rising, forcing the increase in prices.

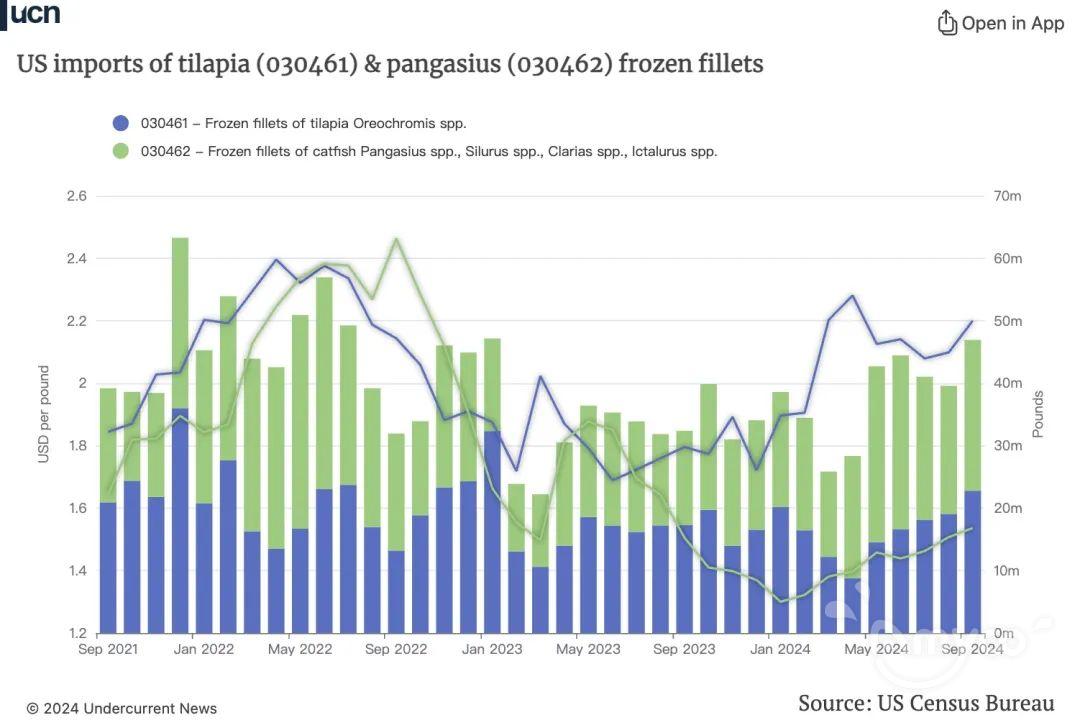

January 2024 is the only month in which imports of tilapia exceeded those of basa. From January to September, the United States imported 149 million pounds of tilapia and 193 million pounds of basa.

Another uncertainty is the outcome of the US presidential election, the new administration of Trump may impose tariffs on Chinese imports next year, seafood import market participants generally expressed pessimism, once the tariff landing, import costs will further rise, the supply chain will face greater pressure.

While waiting for clarity on U.S. tariffs and trade policies, there are also U.S. industry insiders who hope for the growth of domestic farming, but from the perspective of importers, expanding tilapia and catfish farming in a sustainable way or at an affordable price for consumers to replace imports may face great difficulties.

Reference: UCN